# Trend #1: Increase supply chain operational readiness to react responsively to shifting demands

According to Shopify, “last-mile costs represent 41% of supply chain costs in shipping.” By enhancing existing hub-and-spoke models to hyper-localized last-mile delivery, retailers can further increase their ability to meet consumer expectations for delivery speed.

While last-mile options continue to localize, upstream retailers are stepping back from long-standing lean approaches to production and examining what specific problems they need to solve. With our in-depth supply chain operations experience, retailers frequently ask whether they should focus on lean or agile operations. A winning strategy in 2023 is a mix of both.

Retailers looking to further reduce lead times and waste should consider what product lines can shift from lean production environments to a more on-demand or agile production design. This change doesn’t come without challenges.

This switch will require retailers to completely rethink their KPIs, as they shift from a predictable and productive mentality to an agile and reactive one. This can translate into higher short-term costs associated with reconfiguring ways of working, programming machinery, and even renegotiating with suppliers. However, retailers willing to make this shift or even move to a hybrid model will build resiliency in a market where shortened product life cycles and volatile customer demand require transformational approaches to traditional manufacturing.

# Trend #2: Responsive pricing models to engage the cost-conscious consumer

The impacts of inflation and fears of recession remain top of mind for most consumers. This is resulting in an increase in the diligent shopper, a consumer willing to spend time researching what they plan to buy. This research with an eye toward savings is leading to an increasing appetite for private labels that offer quality at a lower price. Numerator recently reported that “4 of 5 most popular private labels are Walmart Brands” and that “$1 in $5 spent in online grocery is private label branded.”

Further reinforcing this trend, a recent survey found that 44% of consumers say they are taking better advantage of sales, discounts, and promotions. Clearly, while spending may remain volatile, retailers who offer cost-sensitive options such as private labels, sales, discounts, promotions, and resale, will remain in the game.

# How will inflation impact consumer behaviors? Here are our 6 predictions for retailers to keep in mind:

- Dine In, Save More – Consumers will eat out less and increase the number of meals cooked at home. Additionally, they will gravitate more toward generic brands to counteract rising grocery costs.

- Essential Health and Wellness – Consumers will continue to spend on health, personal care products, and essential clothing. Spending on wellness products will continue to increase.

- Repair over Replace – DIY and home repair projects will continue to increase and home improvement stores will meet consumer needs better than before.

- Lipstick Effect – This translates to, for example, I may not go on vacation, but I can still look good resulting in increases in cosmetics and beauty product purchases.

- Stretch the Dollar with Discounts – Consumers will be asking: “Can I buy it at a discount?” Discount retailers such as Dollar Tree and Walmart will see an increase in growth and sales.

- Luxury Retail Trends: The Rich are Still Rich– The luxury goods sector counts on roughly 20% of its clientele, the ultra-wealthy and very-wealthy for most of their sales. Therefore, while inflation may push out middle-class consumers from the luxury market, inflation overall will have less of an impact on this sector.

# Trend #3: Bringing a human element to retail omnichannel strategy to increase brand loyalty

The last three years accelerated digital transformations for retailers. Now, retailers are shifting from digital growth to improving the quality of experiences across channels. With inflation’s impact on consumer spending and the increased likelihood of brand switching among cost-conscious consumers, retailers will look to grow consumer loyalty and satisfaction to drive retail sales through humanized customer experiences.

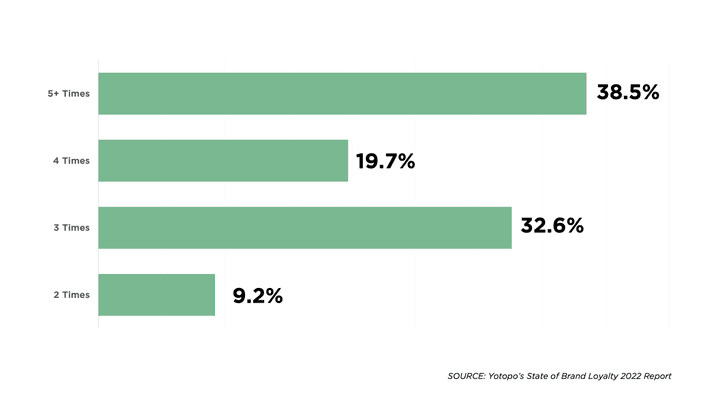

According to Yotpo’s State of Brand Loyalty report, 38.5% of global shoppers said they’d have to purchase from a brand 5+ times before considering themselves loyal. To develop long-term loyalty among customers, companies need to deliver positive customer experiences repeatedly.

# How many times do you buy a certain brand before you consider yourself loyal?

Personalization is one way to build loyalty and bring a human element back to digital experiences. Most companies focus on pre-purchase when they should look at the end-to-end customer journey and offer personalized loyalty programs and rewards. This proactive hyper-personalization approach identifies and anticipates customer needs by serving impactful content and programs unique to individual consumers’ behaviors and mindsets.

With consumer in-store foot traffic continuing to rise, retailers are also thinking of how to differentiate the in-store experience — and it begins before the customer even opens the door. Successful retailers will prioritize phygital experiences. This requires brands to develop deep, personal, and digitally based relationships with their customers. Linking digitally driven personal insights with unique in-store experiences will help brands evolve the customer experience from the generic to the deeply personal (and human), which will in turn drives brand loyalty.

Related Content: 3 Customer Experience Trends for Retailers in 2023

# Trend #4: Brands align with purpose to meet consumer demands for sustainability

Consumers aren’t just researching price; they are aligning with purpose. Surveys suggest that as much as “82% of consumers want their businesses and brands to put people and the planet before profit.” Retailers now find themselves navigating where to invest in environmental, social, and governance (ESG) actions while still working to right-size inventories and prioritize consumer investments that will move inventory faster.

A renewed focus on green initiatives to divert operating costs aligns these two seemingly competing priorities. For example, we’re seeing more retailers offer product repair services to improve environmental impacts and reduce product returns entering back into the supply chain. This circular store concept will become increasingly more common within apparel and footwear companies as we experience the confluence of rising consumer demand for sustainability in fashion and the increase in cost-conscious consumers.

# A forward view of retail trends for 2023

Where 2023 will take us is still to be determined. But for those who want to step into the year with intention, now is the time to explore the opportunities and identify how you will meet expectations while readying your organization for the inevitable shifts in behaviors that will follow.